Elasticity: Concepts and Applications Resources

Overview

In this topic, students will be introduced to the concept of elasticity. They’ll learn about price elasticity of demand and price elasticity of supply, about their determinants and how to calculate it. They’ll be introduced to some applications of price elasticity. They’ll also learn about two other important elasticity measures, cross-price elasticity and income elasticity.

Learning Objectives

- Define the general concept of elasticity (2,5,12,16)

- Define price elasticity of demand and price elasticity of supply (7,12)

- Calculate and interpret the meaning of price elasticity coefficients of demand and supply (7,12)

- Explain the determinants of price elasticity of demand and supply (7,12)

- Identify and discuss some important applications of price elasticity including tax incidence and the effect of elasticity on total revenue (2,5,12,16)

- Define and explain the significance of income elasticity and cross-price elasticity of demand (2,5,7,12)

NOTE: This module meets Ohio TAGs 2, 5, 7, 12 & 16 for an Intro to Microeconomics course

Recommended Textbook Resources

Principles of Microeconomics 2e: Elasticity

Chapter 5. Elasticity (all sections). This chapter covers all the learning objectives except for #4 above.

Full Citation: Greenlaw, S. and Shapiro et al. Principles of Microeconomics 2e. OpenStax CNX. June 4, 2018. OpenStax, Principles of Microeconomics 2e.

Principles of Economics: The Price of Elasticity of Demand

Section 5.1 covers the determinants of price elasticity of demand which is

learning objective 4. It also describes the relationship between price elasticity

and total revenue, part of learning objective 5.

Principles of Economics: Price Elasticity of Supply

Section 5.3 covers price elasticity of supply and includes a discussion of its determinants.

Full Citation: University of Minnesota Libraries, Minneapolis, MN. Principles of Economics, Publishing Ed. 2016. University of Minnesota, CCA, 2016.

Supplemental Content/Alternative Resources

Alternative Textbook Resource

Principles of Economics: Responsiveness of Demand to Other Factors

Section 5.2 gives another take on cross-price and income elasticities.

Full Citation: University of Minnesota Libraries, Minneapolis, MN. Principles of Economics, Publishing Ed. 2016. University of Minnesota, CCA, 2016.

Alternative Video Resources

The following three videos, which are produced by George Mason University cover price elasticity of demand, how to calculate it, and elasticity of supply, respectively. All three videos run about 15 minutes each, which may be too long for classroom use. However, they are comprehensive and may be useful for student viewing outside of class (and may be useful to instructors as well).

- Marginal Revenue University: “Elasticity of Demand”: This video provides a good overview and explanation of the concept of price elasticity of demand. Viewing time is 13:35 minutes.

- Marginal Revenue University: “Calculating the Elasticity of Demand”: This video gives a detailed look at the calculation of price elasticity. It shows the midpoint method. It also looks the relationship between price elasticity and total revenue. Viewing time is 15:51 minutes.

- Marginal Revenue University: “Elasticity of Supply”: A companion to the video on demand elasticity. It takes a closer look at supply elasticity and its determinants. The video may offer too much detail to students but may be useful for instructors. Viewing time is 14:17 minutes.

Active Learning Exercise

Elasticity and Tax Incidence

The point of this exercise is to get students to understand how the relative price elasticities of supply and demand are what really determine who bears the burden of an excise tax. The website indicates what information is to be given to students and offers notes and tips on teaching.

Elasticity and Total Revenue: Context Rich Problem

This activity involves a single scenario-based problem. In the problem students will need to determine if demand is likely to be elastic or inelastic. Then they will need to link elasticity to the effect of a price change on total revenue.

The exercises listed above are included in Starting Point: Teaching and Learning Economics.

Questions and Problems

Questions:

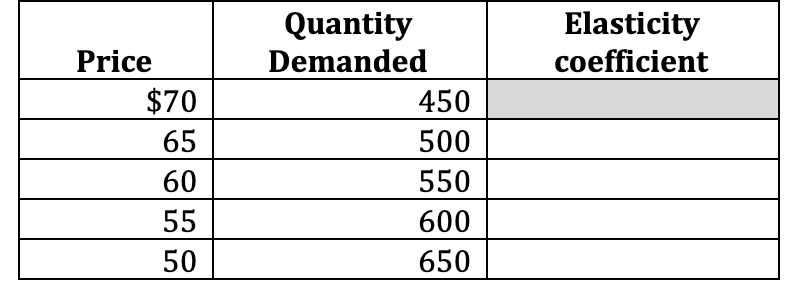

- Below is the demand schedule for a good.

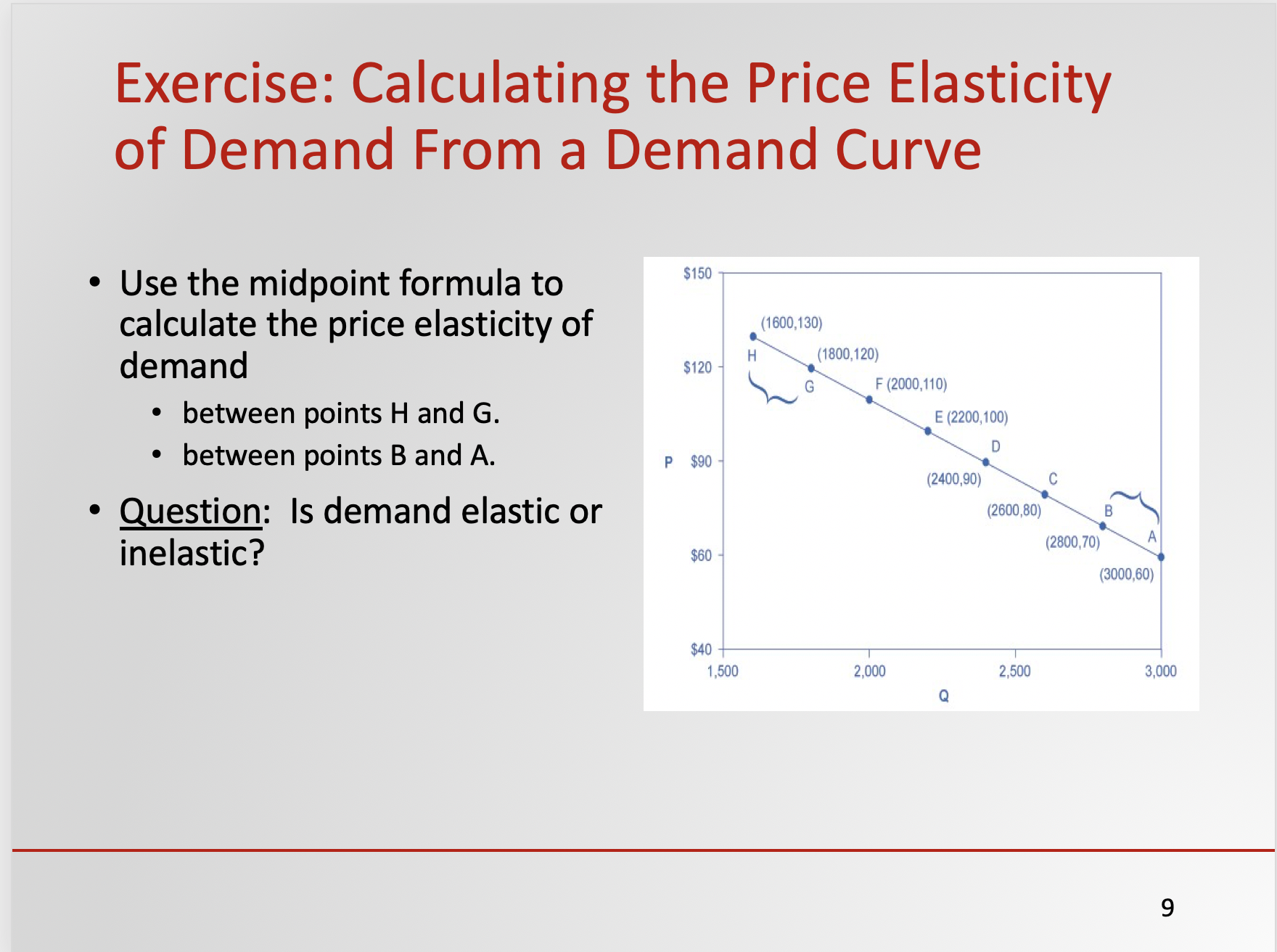

Using the midpoint formula, calculate the price elasticity of demand between:- Price = $60 and price = $55

- Price = $55 and price = $50

- Price = $50 and price = $45

- Price = $45 and price = $40

- Characterize the demand for each of the following goods or services as perfectly elastic, relatively elastic, relatively inelastic or perfectly inelastic. Explain your reasoning.

- A BMW sedan.

- Common table salt sold at the grocery store.

- Kidney dialysis services.

- Cosmetic surgery.

- Most economists would agree that the long-run elasticity of demand for gasoline is higher than the short-run elasticity. Give some reasons why this could be true.

- Excise taxes are often imposed on goods that tend to be addictive in consumption, like cigarettes or liquor. With such goods, who will bear most of the incidence of the tax, the buyer or the seller? Explain.

- You own the Mid-State Spa Co. A retail consultant you hired to help you grow your company tells you that you should lower the price of your spas to increase sales. What is she telling you about the elasticity of demand for spas? Explain.

- A grocery store manager noticed that during the week after the price of hamburger rose from $5/lb. to $5.80/lb., sales of boneless chicken breasts rose from 100 lbs. to 140 lbs. Based on these numbers, what is the cross-price elasticity of demand between hamburger and boneless chicken breasts? Are they substitutes or complements? Explain.

- Rank the following goods from what you think would have the lowest to highest income elasticity. Explain your ranking.

- Rolex watches

- Vintage wine

- Store-brand green beans

- Not-from-concentrate orange juice.

- Meals at Panera Bread or other fast-casual restaurants.

- You estimate the price elasticity of demand for tickets to your Golf and Games Pavilion to be 2.5, which you know makes demand elastic. However, when you lowered the price of a ticket by 20 percent, your sales remained basically flat. There are similar businesses in town and you know that the regional unemployment rate has been edging up. What other elasticity concepts might help explain your flat sales?

Answers:

- …

- 1.4 elastic

- 1.2 elastic

- 1.0 unitary

- 0.8 inelastic

- …

- Relatively elastic. There are numerous alternatives to BMWs (Audis, Mercedes, Lexus, etc.).

- Relatively inelastic. Common salt is a small budget item and there are not many alternatives. Fancy sea salts endorsed by famous chefs and sold in specialty stores are likely more elastic.

- Perfectly inelastic. The procedure is essential to life and there is no viable alternative other than a kidney transplant.

- I would say relatively elastic. There are non-surgical alternatives.

- Short run elasticity of demand for gasoline is quite inelastic because in there are few alternatives to driving to work or school or shopping. Over the long run, people can find public transportation or carpool. They may move closer to work or find a work-from home job. They can also buy a more fuel efficient car.

- Such goods, also called “sin” goods have a very inelastic demand. Therefore, the price increase due to the additional tax would not reduce quantity demanded that much. The buyer would have the more inelastic curve and therefore, bear the greater incidence of the tax.

- She’s telling you that the demand for spas is price elastic. Lowering your price by 10% would increase your sales by more than 10% and thus grow your total revenue.

- The cross-price elasticity is 2.2. The fact that it’s positive means that the goods are substitutes. When the price of hamburger rises, sales of boneless chicken breasts also rise.

- Subject to opinion so no absolutely correct answer.

- Store-brand green beans - may be an inferior good

- Not-from-concentrate orange juice - normal good

- Meals at Panera Bread - normal good

- Vintage wine - strong normal good (superior good)

- Rolex watches - strong normal good (superior good)

- May be too obscure a question for a principles class but students may pick up on the idea that prices at similar establishments may also have fallen and that income may also have declined.

PowerPoint Slides

Elasticity: Concepts and Applications PowerPoint Slides Download