Profit Maximization in Competitive Markets Resources

Overview

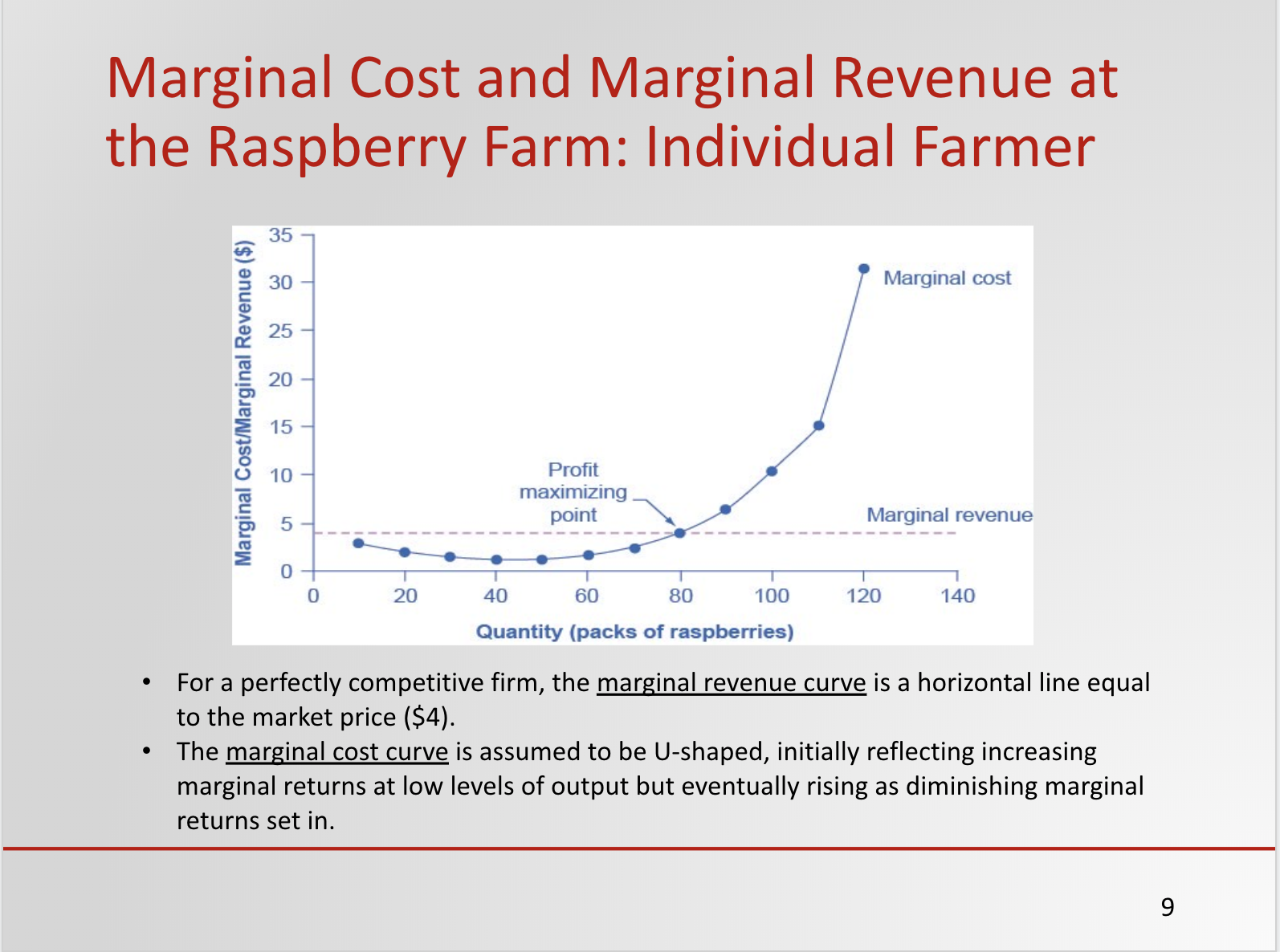

This topic presents an analysis of firm behavior under perfect competition. It begins by identifying the requirements for perfect competition. It then covers the definitions and meaning of costs in the short and long run, describes the firm’s profit-maximizing output decision and its entry-exit decisions. It ends with a discussion of the efficiency implications of perfect competition.

Learning Objectives

- Identify the conditions for perfect competition (2, 5, 10)

- Explain the usefulness of the perfectly competitive model (2, 5)

- Determine the profit-maximizing output in perfect competition (10)

- Calculate short-run profits or losses (2, 9, 10)

- Evaluate entry and exit decisions in the long run (2, 4, 9, 10)

- Explain long-run profits in perfect competition (5, 10)

- Identify how perfectly competitive markets are efficient (2, 5)

- Determine consumer, producer, and market surplus (2, 5)

- Define technical and allocative efficiency (2, 5)

NOTE: This Module meets Ohio TAG's 2, 4, 5, 8, 9 and 10 for an Intro to Microeconomics Course OSS004

Recommended Textbook Resources

Principles of Microeconomics 2e

License: Principles of Microeconomics 2e by OpenStax is licensed under Creative Commons Attribution License v4.0

© 1999-2018, Rice University. Except where otherwise noted, textbooks on this site are licensed under a Creative Commons Attribution 4.0 International License.

Chapter 8: Introduction Perfect Competition

Chapter 8.1. Perfect Competition and Why It Matters

Chapter 8.2. How Perfectly Competitive Firms Make Output Decisions

Chapter 8.3. Entry and Exit Decisions in the Long Run

Supplemental Content/Alternative Resources

Khan Academy Series on Microeconomics: Forms of Competition

The site includes 6 videos, 3 text sections and 4 practice sets. This is a well-produced alternative presentation to the recommended text that may be helpful to students and instructors.

Active Learning Exercise

Game: #39 |

|

Course: | Micro and Macro |

Level: | Principles and up |

Subject(s): | Free entry and exit |

Objective: | To illustrate the dynamics of entry and exit in a multi-market economy. |

Reference and contact: | Garratt, Rod. "A Free Entry and Exit Experiment." Journal of Economic Education. 31(2), Summer 2000, pp. 237-243. garratt@econ.ucsb.edu |

Abstract: | Students take on the role of farmers who must decide whether to enter one of four markets (corn, wheat, rice, or soybeans). Production costs differ for each crop and market prices depend on the amount supplied and consumer demand. Demand is simulated through a pre-determined inverse linear demand function with a slope of negative one. The classroom is divided into four market areas. Each student/farmer makes their supply decision by physically going to the market area they wish to enter (each farmer only supplies one unit of production per period). The number of farmers in a given market is totaled and the market prices and profits are then reported to all. The process is repeated for several periods until all markets yield equal (zero) profits. After a long-run equilibrium is achieved, a second stage is played in which a "Government Fallow Program" is instituted. The GFP guarantees each farmer $1 profit if they do not plant any crops (which is indicated by having the students physically move to the center of the room). Profits in the agricultural markets converge toward $1 or $2 within several periods. Topics for discussion can focus on the distinction between accounting and economic profit, barriers to entry, and the effect of government regulations. |

Class size: | 10 to 50 students. |

Time: | One class period. |

Variations: | None indicated. |

See also: | Market entry games |

http://w3.marietta.edu/~delemeeg/games/games1-10.htm#g006

Questions and Problems

Profit Maximization in Competitive Markets

Questions and Problems

Instructors can add a Google Doc of the Profit Maximization in Competitive Markets Questions and Problems to their Google Drive or download a Word File of the Profit Maximization in Competitive Markets Questions and Problems.

Questions

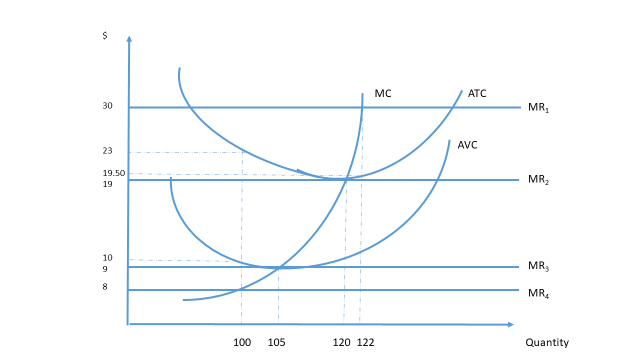

Use Figure 1 to answer questions 1-6

Figure 1

- In what price range will this firm make a positive profit?

- In what price range will this firm operate at a loss?

- In what price range will this firm shut down in the short run?

- If the market price is $8, what will this firm’s output and profit or loss be?

- If this firm is representative of all firms in the industry, what will the long-run price be?

- Assume the market price is $30.

- What will the firm’s output be?

- What will the firm’s revenues be?

- What will the firm’s costs be?

- What will the firm’s profit be?

- In the long run, what is most likely to happen in this industry?

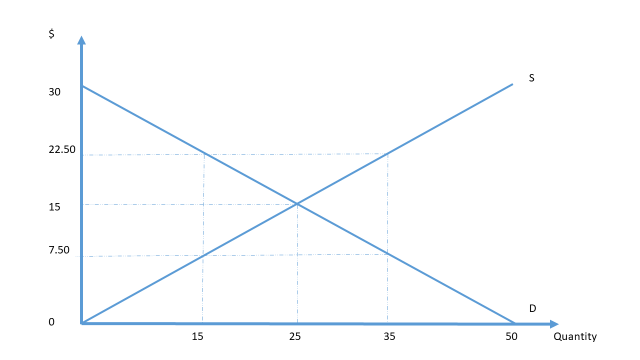

Use Figure 2 to answer the next set of questions

Figure 2

- In competitive equilibrium, what is

- Consumer surplus?

- Producer surplus?

- Total economic surplus?

- Assume a price floor of $22.50 is imposed. What is

- Output?

- Consumer surplus?

- Producer surplus?

- Deadweight loss?

- If a price ceiling of $7.50 is imposed,

- Will there be a surplus or a shortage?

- Describe the transfer of surplus.

- How much surplus is transferred?

- Is society better off or worse off?

Answers - First Set of Questions

- $19 - $30

- $9 - $19

- Below $9

- q = 0; losses equal fixed cost, $1300 [AFC is $23-$10; FC is $13 x 100]

- $19

-

- 122

- $3660

- $2379

- $1281

- New firms will enter

Answers - Second Set of Questions

-

- $187.50

- $187.50

- $375

-

- 15

- $56.25

- $281.25

- $75

-

- Shortage

- Some of the equilibrium producer surplus is transferred to consumers.

- $112.50

- Worse off: there is a deadweight loss of $75